Author | Patricia LicerasToday, it is easy to get around large cities in private vehicles without having to own them thanks to traditional renting and other modern formulas such as vehicles with drivers or shared cars. There are a growing number of options and these new forms of transport are changing, not just our perception of mobility, but the automotive sector as a whole, as indicated in various studies.A recent report drawn up by Europcar Mobility Group Spain revealed that seven in ten drivers believe these forms of transport will end up replacing car ownership in the short to medium term. Most, 58.6%, believe it will disappear within ten years or even less, while 11.7% believe it will take longer, occurring probably within the next 20 years or more. Either way, 71.4% consider shared vehicles to be the most feasible alternative for replacing car ownership.

By 2030, one in three kilometres driven will be ‘shared’

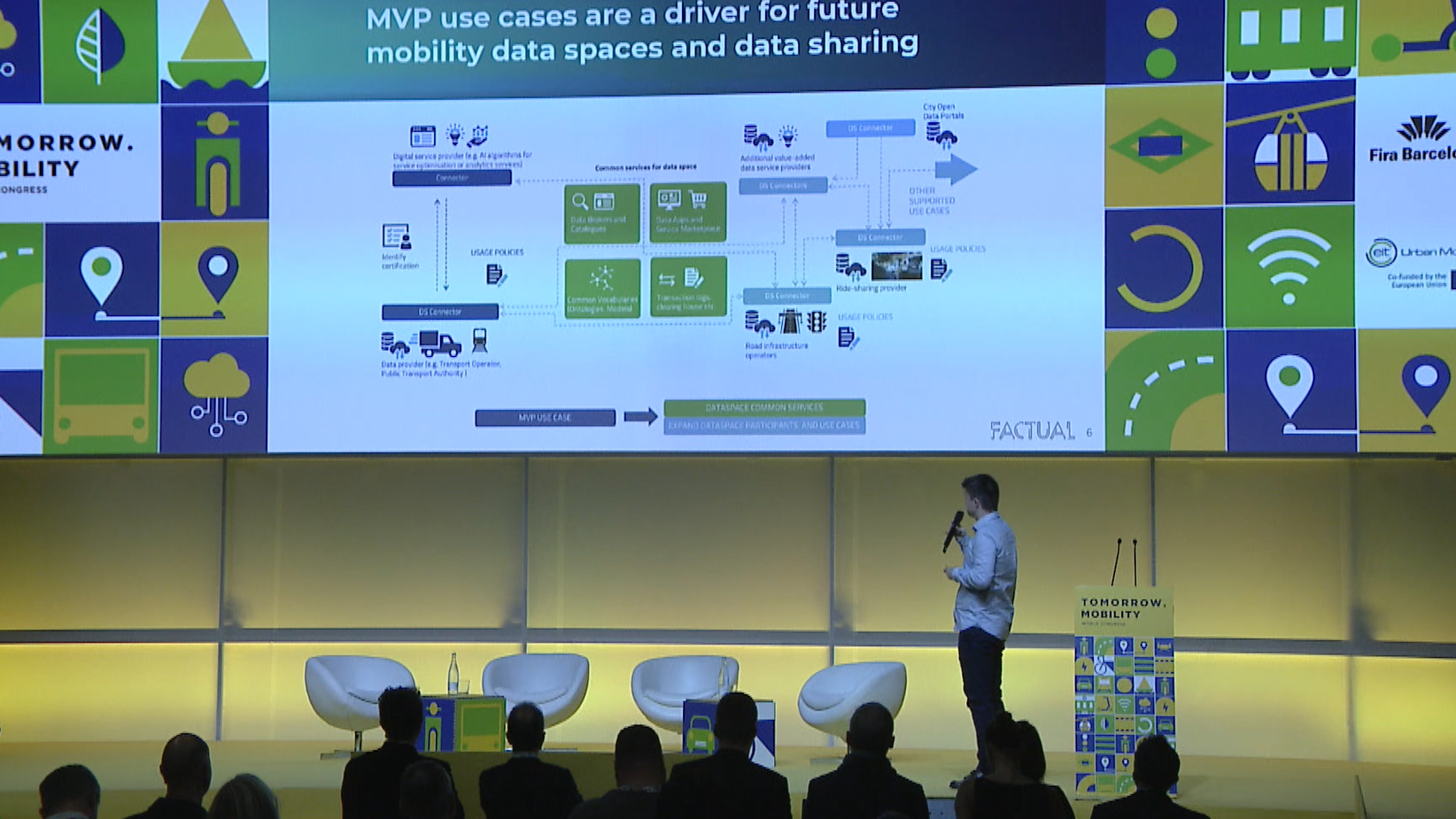

The figures in this study coincide with the conclusions of another European study conducted by PwC (PriceWaterhouseCoopers), entitled "Five trends transforming the Automotive Industry". According to the study, less than 1% of all car journeys in Europe are currently made using shared transport services. A percentage that by 2030, in Europe could reach 35% of the kilometres driven, 34% in the United States and 46% in China.According to the document, “Once the technical difficulties and uncertainties have been resolved in terms of regulations, the kilometres driven in shared transport will increase substantially”.

Lower stock of vehicles and more registrations

In this regard, and during a process closely related to the impact of shared cars and technological development, the stock of vehicles is expected to drop in Europe by 25% -from 280 to 200 million units- by 2030. In the United States, the drop would be similar, nearing 22% and going from 270 to 212 million cars.Paradoxically, this lower stock is expected to coincide with a climb in registrations which, by 2030, will increase in Europe by 34% (from 18 to 24 million units) and by 20% in the United States (to 21.6 million vehicles).The reason is relatively simple. The use of shared cars is much more intensive; therefore the average useful life of shared cars is reduced considerably, meaning they will need to be replaced within a shorter period of time. According to PwC, a car used for car sharing is used for more hours of the day and will cover an average of 58,000 kilometres, more or less the same as a taxi, compared with the average of 13,230 kilometres driven by a conventional vehicle.

Great innovative efforts

In a scenario in which car ownership is no longer a priority compared with new forms of transport, “all stakeholders within the sector must be prepared for a profound period of transformation” according to PwC. And it warns that the transition towards that new automobile scenario is going to be particularly delicate for traditional manufacturers and suppliers, who will have to “invest greatly in innovation” if they want to get ahead in a market with increasingly narrow margins and more competitors than ever.Specifically, “they won’t be able to focus their business models solely on production and sales processes; they will also have to focus on different types of uses and the vehicle’s entire lifecycle”. And only manufacturers that are able to adapt to this transport revolution will be able to guarantee their medium-term future.Images | Keith Wickramasekara/Unsplash, Nick Fewings/Unsplash, Thought Catalog/Unsplash