Author | Lucía Burbano

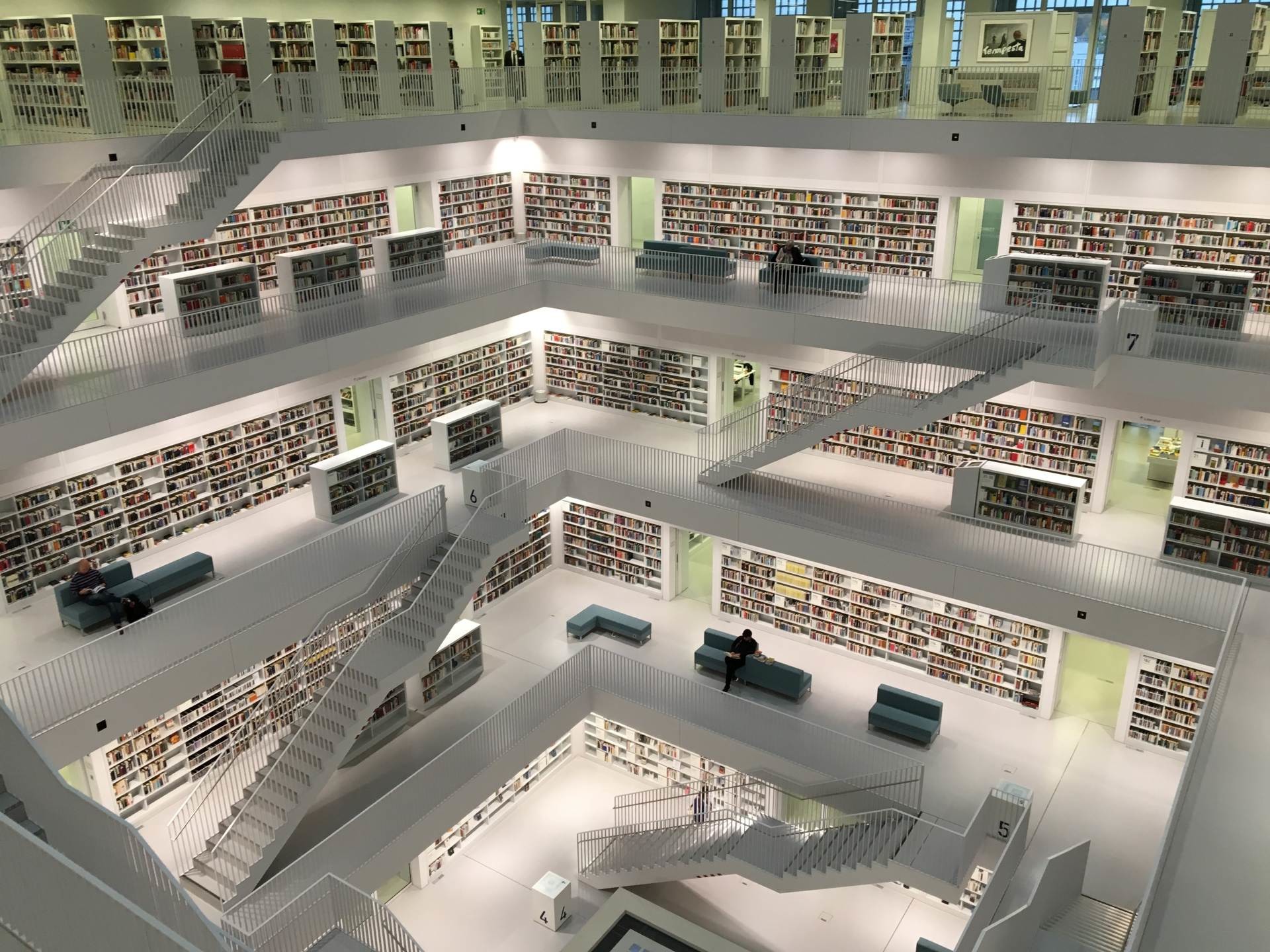

They arrived in cities during the COVID-19 pandemic and it seems like they are here to stay. The closure of restaurants saw an increase in food delivery services and this food went on to be prepared in ghost kitchens. However, some cities are now starting to legislate a sector which, to date, has been able to take advantage of the existing legal vacuum.

The ghost kitchen phenomenon

Ghost kitchens came about as a result of a requirement: to prepare food deliveries during the Covid-19 pandemic, when physical contact was to be avoided due to the risk of infection.

Generally speaking, they are characterized by:

A menu based on data

Ghost kitchens prepare their culinary offerings based on data that identify customer preferences in an area and which can be fulfilled with various brands. From a single kitchen in which pizzas, hamburgers or salads are prepared and dispatched very quickly.

Lower costs

The owner of a traditional restaurant has to meet a series of requirements and own licenses, machinery or undergo inspections, while dark kitchens do not have any expenses associated with the operation of a restaurant.

However, cities are keeping a close eye on ghost kitchens for the following reasons:

They are bothersome for residents

The smell of food, smoke from extractor fans in light shafts in buildings, noise and traffic caused by the delivery motorbikes… many residents living next door to ghost kitchens have expressed their concern with respect to these facilities.

They are a threat to local restaurants

The lower costs associated with establishing this business model allows ghost kitchens to compete against restaurants in better conditions: lower prices and faster deliveries, which traditional restaurant owners cannot compete with.

Barcelona is tackling ghost kitchens

In Spain, Barcelona’s City Council is the first city to establish a regulation applicable to ghost establishments, which includes kitchens, to regulate these businesses that sprung up during the pandemic and which operate without any legal framework.

In March 2021, a suspension of licenses associated with macro kitchens was approved and, one year later, the existing usage plan based on a participatory process and which establishes the following:

- Ghost kitchens cannot be located in residential areas and they are limited to industrial land and in very specific conditions: they must be located in streets that are at least 25 meters wide and separated, with no other premises of the same type within a radius of 400 meters.

- Regulating waiting times and riders. The owners of ghost kitchens will have to obtain special authorizations which will include indoor waiting areas for delivery personnel and vehicles, which will be in proportion to the size of the establishment.

Another example is that of São Paulo, in Brazil, which approved a Law to regulate ghost kitchens, allowing warehouses of up to 500 m² with 3 to 10 kitchens in residential neighborhoods. Larger establishments will have to move to industrial areas, since the regulations consider that the activity has detrimental urban and environmental impacts.

Uber Eats is cleaning up

But it is not only cities that are starting to regulate ghost kitchens Uber Eats announced that it will remove 5,000 dark kitchens from its app in the United States, after detecting that they offer the same menu but with different names. This figure represents 13% of the company’s business in the country.

It clearly illustrates an adjustment to the circumstances in view of regulatory changes that are potentially more expensive for the company.

Photographs | Unsplash/Jon Tyson, Unsplash/Cristiano Pinto