Author | Elvira Esparza

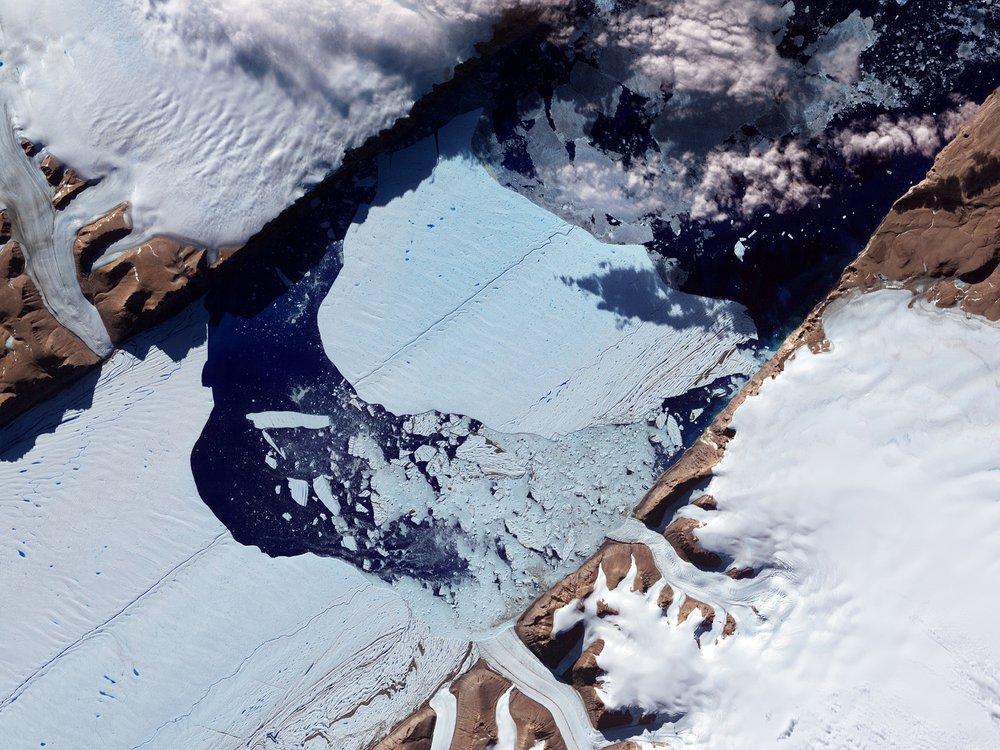

Mandatory remote working imposed by COVID in 2020 continues to leave a lasting impact on office spaces. Although in-person and hybrid working models have resumed, office occupancy levels remain significantly below those seen prior to the pandemic. Empty offices are projected to continue inflicting significant economic losses on cities. The solution lies in reimagining and reconverting these spaces for other purposes.

Cost of empty offices in the United States

In the United States, empty offices currently account for 19.6% of total office space, according to a report by Moody’s Investor Services, which is the lowest level in 40 years. The trend indicates that by 2026, a quarter of all office spaces could remain vacant. New York City has the largest amount of empty office space in the United States, totaling 9.7 million square meters, which is three times the size of Central Park. Chicago ranks as the second city in the United States by the surface area of empty offices, with 5.3 million square meters of vacant space.

In New York City alone, $7.6 billion in annual rental income is lost each year due to vacant office spaces, according to a report by Switch On Business.

Low office occupancy rates have led to a 1.5% drop in rental prices between 2019 and 2023. On the West Coast of the United States, the same trend has been observed. In Los Angeles, it is estimated that $2.1 billion in rental income has been lost due to empty office spaces, while San Francisco has seen losses of approximately $2 billion, while in the cities of Dallas and Houston, losses stand at around $1.6 billion.

A similar situation in Europe

In London, a study by CoStar reveals that the percentage of vacant office spaces has surged by more than 50% since the end of 2019, resulting in a 25% loss in office space value. Far from improving, the rate of vacant offices continues to rise. This year, the vacancy rate reached 10.1%, marking the highest figure in over 20 years. Around 17% of the vacant office spaces in London are located in the Docklands area.

In Spain, the number of office spaces rented dropped by 25% last year in both Madrid and Barcelona, according to a study by the consulting firm JLL. In figures, EY estimates that last year, 420,000 square meters of office space were rented in Madrid, and 220,000 square meters in Barcelona. These figures are significantly lower than those recorded in 2019, which were 612,000 and 400,000 square meters, respectively. Estimates suggest that Madrid currently has 1.4 million vacant square meters of office space, while Barcelona has around 900,000.

Converting vacant offices into housing

The challenge now is how to maximize the potential of vacant office space to halt ongoing economic losses. Hybrid solutions have been proposed, such as renting part of the office space under conventional leases and another part as coworking spaces. This approach offers greater flexibility and allows currently empty spaces to be utilized more effectively.

However, the solution most cities are pursuing is converting office spaces into housing. In New York, the city council has approved a plan to transform empty office buildings into 20,000 new homes.

In Chicago, the LaSalle Street Reimagined project proposes converting vacant office buildings in the city center into residential units and spaces for public services. Around 150,000 square meters will be repurposed, with plans to build approximately 430 affordable homes, among other uses.

In London, there have been proposals to convert empty office spaces in the financial district of Canary Wharf into hotels, retail units, and cultural venues.

In Spain, a study by the consulting firm CBRE highlights that 156 buildings have undergone a change of use in the past ten years. Around 224,000 square meters have been converted into offices, and 164,000 square meters into hotels, primarily in Madrid and Barcelona. But this transformation continues to be unstoppable.

The EY study, The Office Property Telescope, estimates that Madrid and Barcelona have 2.5 million square meters of office space that could be transformed over the next 20 years into 28,000 homes—20,000 in Madrid and 8,000 in Barcelona. Madrid has already approved a plan to convert 1.8 million square meters of office space into 20,000 affordable rental flats.

However, converting office buildings into apartments is a complex process. The building conditions required for housing are difficult to implement in office buildings, meaning a complete transformation is necessary, along with significant investments.

Images | Daniel Lee, Frimufilms on Freepik